La Mer generated more engagement with influencers on social media in the first half of 2018 than any other skincare brand.

According to a new report by Traackr, the world’s leading influencer management platform, La Mer partnered with 1529 influencers to garner more than 12 million engagements across Facebook, Twitter, Instagram and YouTube from January 1 to June 30.

This put Le Mer ahead of other brands, not only in the luxury category but also in the premium, dermatological and consumer skincare categories surveyed by Traakr.

Traackr CEO Pierre-Loic Assayag attributes La Mer’s social media success to the careful balancing of publicity and exclusivity.

“The notion of luxury has always been associated with exclusivity and scarcity,” he said.

“While some of the most forward-thinking global brands are able to manage influencer programs of a few hundred or thousand influencers, luxury brands need to optimise the balance between scaling impact and staying consistent with the exclusivity they wish to preserve.

“La Mer has accomplished both scaling their program successfully and staying authentic to their brand by collaborating with influencers who love their products and have earned trust from their community.”

The ‘State of Influence in Skincare’ report is based on content produced by more than 30,000 top global skincare influencers in five skincare categories: Luxury, Premium, Retail, CPG and Dermatological.

Additional key insights include:

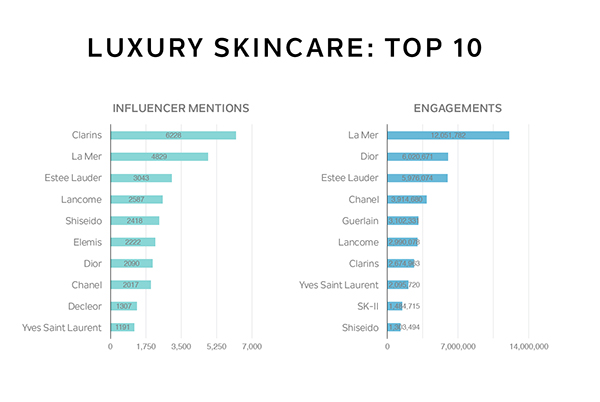

Luxury: Clarins topped the influencer mentions chart (6228) but was in 7th position in engagements (2.6 million+) and video views (14.2 million+) while Dior garnered only 2090 mentions but achieved over 6 million engagements and over 90 million video views.

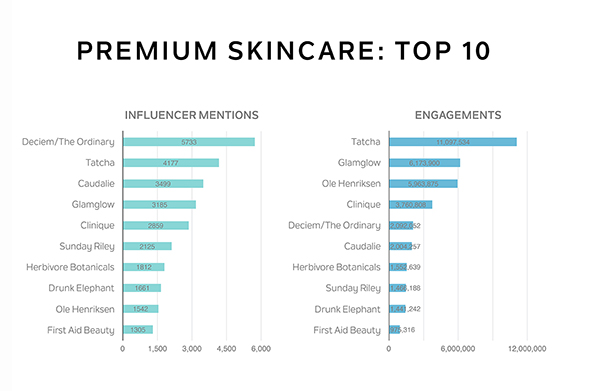

Premium: Deceim’s The Ordinary skincare line had the most influencer mentions (5733) but was in 5th position for engagements (2 million+) and 6th for video views (13 million+) while Tatcha, in 2nd place for mentions (4177), generated the most engagements (11 million+) and video views (70.27 million+).

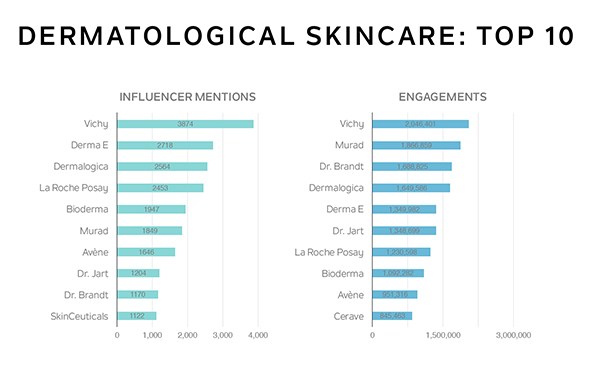

Dermalogical: Vichy lead the pack with 3874 mentions and over 2 million engagements but dropped to 5th position in video views (11 million+) while Derma E was in 2nd place for mentions (2718) but was in 5th position for engagements (1.3 million+) and 10th for video views (6 million+).

Consumer Retail: Origins garnered the most mentions (4215), engagements (3.38 million +) and video views (27 million+) from influencers, while Keihl’s claimed second place for 3887 mentions and fourth place for engagements (2.8 million+) and video views (14.7 million+)

Consumer CPG (Consumer Packaged Goods): Olay and Dove dominated this category. Dove earned 6766 mentions by top influencers compared to Olay’s 4606 while Olay had 3.5 million+ engagements versus Dove’s 1.42M. The brands were more equal with Dove recording 9.5million+ video views compared to Olay’s 9.2 million+.

According to Assayag, the role of influencer marketing has changed significantly in the last few years.

“During influencer marketing’s infancy, brands viewed influencers as just another media channel to push their messages out,” he says.

“Now, the most successful skincare companies see influencers as a long-term investment for their own brands.

“They focus on authentic relationships over straight ad buys that can impact everything from future marketing strategies to customer support to product development.”