Skincare products are driving prestige beauty sales in the US, according to the latest report from the NPD Group.

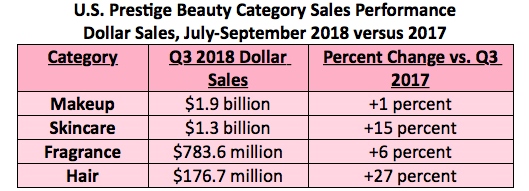

According to the company’s new US Beauty Total Measured Market report, prestige beauty sales in the US reached a massive US$4.1 billion in the third quarter of this year − seven percent more than in the same period last year.

NPD Group beauty industry analyst Larissa Jensen said the 15 percent year-on-year increase in skincare sales was the major driver behind the growth.

The prestige market is now comprised of makeup (US$1.9 billion), skincare (US$1.3 billion), fragrance (US$783.6 million) and hair (US$176.7 million).

“The big story for the third quarter is the acceleration in skincare, which is growing more than twice the rate of fragrance and 15 times faster than the rate of makeup,” she said.

“We continue to see natural brands and entry price categories fuel the skincare category, but the big shift this year is the renewed interest in new products from legacy classics in the anti-aging category.

“With consumer confidence breaking records, the two highest priced beauty categories of skincare and fragrance may be reaping the benefits of a bigger wallet.

“Despite the success of its sister categories, makeup continues to struggle, being the most impacted by a highly fragmented marketplace.”

Other key findings in the report are:

Skincare

- Natural brands accounted for more than one-quarter of skincare sales, and also grew the fastest in Q3 (+24 percent).

- Age specialist products grew 14 percent in sales, an acceleration of growth over Q3 of last year.

- Face mask sales were up 12 percent, though growth has slowed compared to last year.

- Toners/clarifyers grew by 25 percent in Q3, a significant growth increase from Q3 2017 when sales were up 5 percent.

Makeup

- Total face, the largest segment in makeup, grew its sales by two percent, driven by concealer, powder, and tinted moisturiser.

- Lip colour sales declined by 10 percent, while lip gloss grew by four percent.

- Eyebrow makeup grew by seven percent and mascara by twp percent, while eye shadow sales were down six percent.

- Though a small US$13.5 million piece of the market, sales of false eyelashes grew by 30 percent.