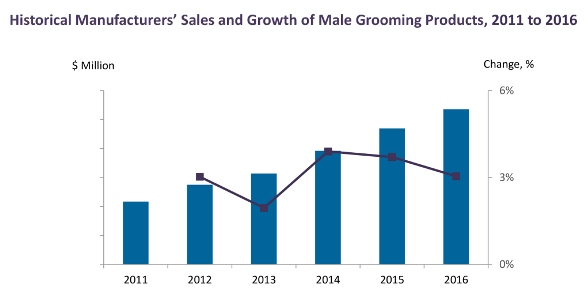

The obsession with all things beauty is no longer limited to women. New research shows that male grooming has become one of the industry’s fastest changing, and fastest growing segments.

According to Kline, a global consulting and research firm, the US market reached a staggering 4.5 billion last year – and is set to keep on growing.

Naira Aslanian, the lead author of the company’s ‘Male Grooming Products: US Market Analysis and Opportunities’ report, taboos surrounding male beauty regimes “are slowly dropping”.

“A growing number of men are using anti-ageing serums and masks, beauty devices, and even makeup,” she said.

“While makeup for men is a trend now and brands such as Covergirl and Maybelline are debuting their first male ambassadors, it is categories like skincare and personal cleansing that are seeing the most innovation and progression.

“Traditional male-oriented categories, such as deodorants and antiperspirants, are also posting strong gains driven by innovations like anti-mark antiperspirant technology.”

In addition, she said the increased purchasing power of “millennial men, who follow trends set by looks-conscious celebrities, take the notion of self-care to a different level”.

“The desire to associate themselves with a lifestyle synonymous with success and wellbeing turns male consumers to barbershops and male-centric salons offering personalised services and pampering.”

Aslanian stressed that large companies lead the men’s market with Unilever being the undisputed Number 1 through brands like Dove Men+Care, Axe and Degree.

However, she said the “increased acceptance of personal care and spending on it” is likely to offer more business opportunities in the booming segment.

“A number of the new players that have entered the category will gain increasing shelf space at stores and salons alike.”

Other key insights from the report include:

Magic Boxes

Subscription shaving services have evolved into a multimillion-dollar category with rising new players such as Harry’s, 800Razors, and Bevel. Cosmetics giants have taken note − Unilever has acquired the Dollar Shave Club, Procter & Gamble has launched its own Gillette on-demand text razor ordering service and Jack Black has launched its own luxury razor service.

Convenient Outlets

Convenience is key as the internet becomes the leading and fastest growing channel for male grooming products, fuelling further development of the segment by allowing men to make their own choices in terms of product and pricing. The internet is expected to further help with delivering products that men would feel uncomfortable purchasing in stores.

Marketing Buzz

While online marketing and promotions through social media influencers are prevalent in the women’s category, they do not yet yield similar results in male grooming. Marketing to men is largely through product reviews in men’s magazines and targeted advertising using social media.

Power Products

Men are increasingly opting for high impact products, such as face masks and anti-ageing serums, to prevent and reverse signs of ageing.

The Smaller Guys

High growth potential and opportunities in this previously under-served market have given rise to niche brands creating effective products in innovative packaging. Male grooming indies will continue to shine in this category, making their way into the staples used by men for their everyday grooming needs.