Lipstick sales are the driving force behind the growth in China’s coloured cosmetics sales, according to the latest research by Mintel.

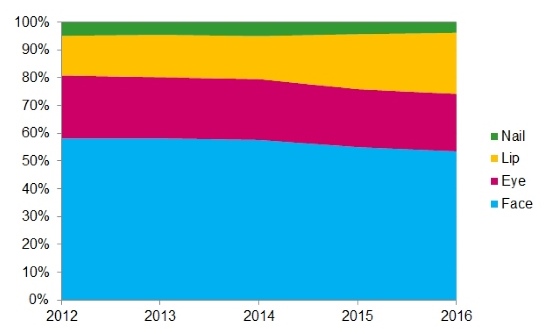

The marketing intelligence company’s ‘Color Cosmetics China 2017’ report has found that lip colour’s share of China’s makeup sales increased from 15 per cent in 2016 to 22 percent last year – and looks set to continue to grow further as 63 percent of Chinese women believe it is the most important colour cosmetic product.

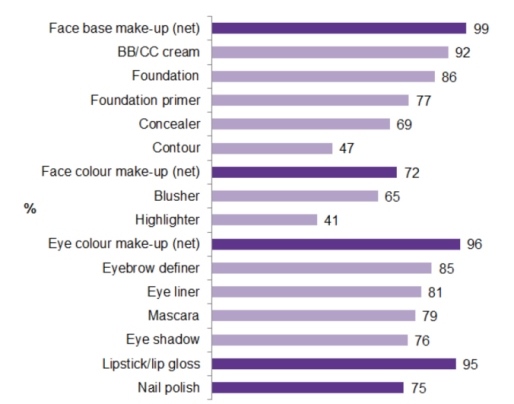

Mintel associate beauty director Jessica Jin said lipstick use is now “nearly universal in China with 95 percent of urban Chinese female consumers having used lipstick/lip gloss in the past six months”.

“There is strong consensus across China that using make-up is a useful technique to boost confidence, and at the same time, show respect for others,” she said.

“Sixty-two percent of urban Chinese women claim they wear makeup almost every day, up from 38 percent of surveyed women who said the same in 2016.”

She said the company’s research has also identified the growing popularity of ‘natural’ and ‘make-up-free’ beauty trends among Chinese colour cosmetics consumers.

“It is easy to see that ‘natural’ and good, healthy looking skin are currently the big trends in makeup, surpassing the general goal of being ‘beautiful’,” she said.

“Chinese women’s ideal make-up look centres on ‘natural’ (41 percent), followed by ‘fresh’ (17 percent), ‘light makeup’ (12 percent) and ‘nude makeup/no makeup’ (12 percent), indicating a clear desire for good, healthy skin.

“This is especially true among women aged 20-24 who have a much stronger desire for a fresh-face look.”

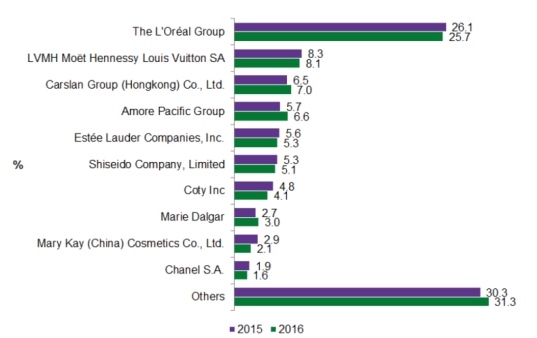

The report also found that Chinese consumers are showing more love towards Chinese beauty brands as they are selected by more than 25 percent of makeup wearers.

“In recent years, we have seen the growth of Chinese brands, not only in the colour cosmetics category, but across beauty and personal care categories,” said Jin.

“What Chinese brands are selling is not patriotism, but rather increasing product quality and inherited brand equity and technology.”

“[Although they each still have less than 10 percent of the total market] Chinese brands Carslan and Marie Dalgar and South Korean brand, Amore Pacific, are the companies gaining market share with all of them positioned at the masstige price level.

“Meanwhile, international players, like L’Oreal and LVMH, are increasingly under competitive pressure as newcomers join the market.”

Mintel estimates that China’s colour cosmetics market will grow at a CAGR of 10.2 percent in the next five years to reach RMB 49,662 million by 2022.